Independent mortgage advice from ESPC Mortgages

As a team of independent mortgage advisers, we at ESPC Mortgages are experts in first-time buyer and buy-to-let mortgages, along with remortgaging and mortgage options for home movers. Learn more about how we can help, and get in touch for personalised mortgage advice.

From left to right, our mortgages team: Back row - David Lauder, Matryn Johnstone and Paul Demarco. Front row - Lisa Bell and Megan Conway

Get Expert Mortgage Advice From ESPC Mortgages

You can also get in touch by calling 0131 253 2920 or emailing fsenquiries@espc.com

Our team of mortgage brokers are experts in the process of buying a house or flat. We can help guide you through the entire mortgage process, whether you would like to buy a property in Edinburgh, Glasgow, Dunfermline, Livingston, Musselburgh or many other areas in Scotland and the rest of the UK.

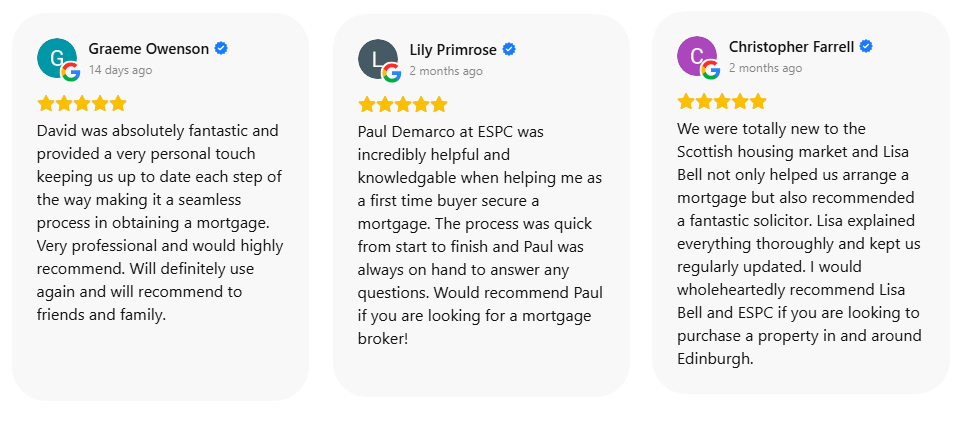

We will strive to ensure you get the right mortgage deal. We pride ourselves on excellent customer service skills and fast turnaround times – on average we can get a mortgage offer for our clients within ten working days. But don’t just take our word for it – the many five star reviews we’ve received from our clients on Google speak for themselves.

We were also winners at the Natwest Local Hero Mortgage Awards (Scotland) and nominated for Best Regional Broker (Edinburgh) at the Scottish Mortgage Awards. Contact us today to find out how we can help you find the best mortgage for your needs.

Why should I use a mortgage advisor?

- Expert knowledge of an ever changing market

- Access to thousands of mortgage products

- Able to source the most appropriate solution for you

- Will carry out all of the admin on your behalf

- Close relationships with many lenders

- Take stress away from you during the mortgage process

Free mortgage tools

At ESPC Mortgages, we realise how tricky it can be to navigate the buying and mortgage process so below are some useful tools that will help you answer key questions on your mortgage application journey.

How much will I be able to borrow?

Check out our useful mortgage calculator to find out how much you could borrow. Calculate how much you can borrow

How much will my monthly repayments be?

Our mortgage calculator also helps you to estimate your monthly repayments.

Calculate your monthly repayment

Get in touch

Whether you need help with your first mortgage, are moving home, investing in a buy-to-let property or looking to remortgage, the expert team of Independent Mortgage Advisers at ESPC Mortgages can help. Get in touch with the team today using the contact form below, calling 0131 253 2920 or emailing fsenquiries@espc.com

Alternatively, pop into our Property Lounge at 27 George Street and talk to our Expert Mortgage Advisors in person, while enjoying a complimentary cup of coffee. You can chat with one of our Mortgage Advisors on the following days and times:

Tuesdays: 12pm – 2pm

Thursdays: 4pm – 6pm

The initial consultation with an ESPC Mortgages adviser is free and without obligation. Thereafter, ESPC Mortgages charges for mortgage advice are usually £395 (£345 for first-time buyers). YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER LOANS SECURED AGAINST IT.

The information contained within this website is subject to the UK regulatory regime and therefore restricted to consumers based in the UK.

The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service, please visit www.financial-ombudsman.org.uk.

ESPC (UK) Ltd is an Appointed Representative of Lyncombe Consultants Ltd which is authorised and regulated by the Financial Conduct Authority.