ESPC House Price Report - March 2012

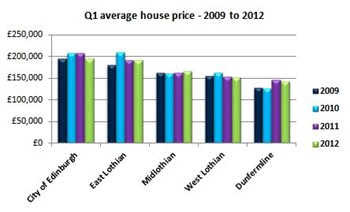

- The average house price in Edinburgh during the first three months of 2012 was £195,221 following an annual fall of 5.9%.

- In most areas of the Capital house prices have returned to levels seen in the first quarter of 2009.

- There has been very little movement in prices in other areas of East Central Scotland with annual changes of around 2% or less in East Lothian, Midlothian, West Lothian and Dunfermline.

- Sellers are showing a greater willingness to accept slightly lower offers for their property which has led to a rise in completed sales. The number of homes sold is up 12% annually during the first three months of the year.

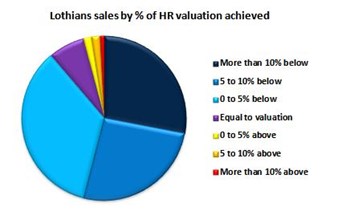

- 16% of homes sold between January and March achieved their Home Report valuation.

Overview

Latest figures from ESPC - the largest property marketing firm in East Central Scotland - show that the average selling price of a property in Edinburgh between January and March was £195,221. This meant prices were 5.9% lower than at the start of 2011 when the average house price in the Capital stood at £207,497.

Other areas of East Central Scotland saw very little movement in prices. In East Lothian, Midlothian and West Lothian the average price during the first three months of 2012 was within 2% of the figure recorded a year ago.

Recent months have seen an upturn in the number of homes selling and this continued in March. During the first three months of the year the number of completed sales was 12% higher than that recorded at the start of 2011.

David Marshall, business analyst with ESPC commented: "Recently we've seen an increased willingness from sellers to accept a slightly lower offer in order to get their sale completed. Over the last three months, over 80% of properties sold have been secured for less than their Home Report valuation, with homes going for an average of about 6% less than the valuation figure. As a result prices have either remained flat or inched down in most areas but the number of homes being sold has risen. Edinburgh has seen a slightly larger decrease in prices compared to last year but in most cases house values are now back in line with, or slightly above the levels we saw at the start of 2009."

David Marshall, business analyst with ESPC commented: "Recently we've seen an increased willingness from sellers to accept a slightly lower offer in order to get their sale completed. Over the last three months, over 80% of properties sold have been secured for less than their Home Report valuation, with homes going for an average of about 6% less than the valuation figure. As a result prices have either remained flat or inched down in most areas but the number of homes being sold has risen. Edinburgh has seen a slightly larger decrease in prices compared to last year but in most cases house values are now back in line with, or slightly above the levels we saw at the start of 2009."

Edinburgh

The average house price in Edinburgh fell by 5.9% annually during the three months to March and now stands at £195,221. This marked the first time the average house price in the Capital over a three month period had dipped below £200,000 since the three months to April 2009.

Smaller homes generally saw greater declines in value. The average price of a one bedroom flat in Easter Road and Leith Walk fell 9.7% annually to £103,000 whilst in Gorgie and Dalry the value of similar properties was down 9.0% to £95,033.

Demand for smaller homes has been most significantly impacted since the economic downturn, with activity from first time buyers and buy to let investors well below pre-credit crunch levels. One bedroom flats in Edinburgh now account for 17% of properties sold in Edinburgh compared to almost 22% of sales in 2006 and 2007.

Although prices in the Capital have fallen, the number of homes selling so far this year has been higher than at the start of 2011. Over a thousand properties have already been sold in Edinburgh - up by over 12% on 2011 and the highest total recorded during the first three months of the year since 2008.

David Marshall explained: "More sellers are now accepting offers below Home Report valuation and this has helped to increase the number of sales being completed. In Edinburgh properties are selling for an average of 5.6% below Home Report valuation compared to 4.6% below valuation last year. Currently 83.6% of properties sold in Edinburgh are being secured for less than valuation - up from 82.6% a year ago.

"As you'd expect the likelihood of achieving the valuation falls the longer a property has spent on the market. Almost half of all properties sold within eight weeks of going on the market achieved a selling price equal to or greater than their valuation. In contrast just one in ten of those which spent more than 12 weeks on the market achieved their valuation."

Lothians

Average house prices in the Lothians between January and March have shown very little movement compared to levels recorded in the first three months of 2011. In East Lothian the average house price rose by just 0.5% annually from £191,539 to £192,514 whilst in Midlothian a year-on-year rise of 1.6% brought the average from £162,855 to £165,512. West Lothian saw a slight fall in the average house price - a 0.8% decrease taking the average in the area from £153,043 at the start of 2011 to £151,774 during the first quarter of 2012.

David Marshall said: "House prices across the Lothians are in line with those we saw early in 2011. As we've seen in other areas, buyers are having a lot of success in negotiating discounts against Home Report valuations. Just 11% of properties sold in the Lothians during the last three months achieved their valuation. 54% were sold for more than 5% below valuation. Although the number of properties on the market is lower than at this stage last year it is still above seasonal norms and we'd expect sellers will continue to enjoy success in negotiations in months ahead."

David Marshall said: "House prices across the Lothians are in line with those we saw early in 2011. As we've seen in other areas, buyers are having a lot of success in negotiating discounts against Home Report valuations. Just 11% of properties sold in the Lothians during the last three months achieved their valuation. 54% were sold for more than 5% below valuation. Although the number of properties on the market is lower than at this stage last year it is still above seasonal norms and we'd expect sellers will continue to enjoy success in negotiations in months ahead."

Dunfermline

The average house price in Dunfermline during the three months to March was £143,507 - down 2.2% from £146,708 a year ago. The average price of a two-bedroom flat in the town was 5.0% lower than that recorded a year ago at £75,812. The values of larger properties was almost unchanged - a 0.1% drop taking the average price of a four bedroom house to £201,889.

The average house price in Dunfermline during the three months to March was £143,507 - down 2.2% from £146,708 a year ago. The average price of a two-bedroom flat in the town was 5.0% lower than that recorded a year ago at £75,812. The values of larger properties was almost unchanged - a 0.1% drop taking the average price of a four bedroom house to £201,889.

18% of properties sold in Dunfermline between January and March achieved their Home Report valuation. Many buyers succeeded in negotiating significant discounts from the valuation figure with some 48% of all properties sold in the town secured for more than 5% below valuation.

David Marshall said: "As is the case across much of the country there are more people looking to sell in Dunfermline than there are in a position to buy. This puts buyers in a position of strength when it comes to negotiating on price so we're seeing many homes being secured for less than their valuation figure. Prices have come down slightly compared to last year but are still ahead of levels seen at the start of 2009 and 2010. Over the course of the year we'd expect to see a similar picture, with prices in line with or marginally below 2011 levels but the number of homes selling rising."

Got a question? Read our House Price Report FAQs.

Want to know about previous months and years? Read our historical house price data.