Changes coming to Stamp Duty Land Tax

As part of the Budget delivered on Thursday 9th October 2014 the Scottish Government announced plans to make changes to the tax paid on the purchase of residential properties in Scotland. From April 2015, Stamp Duty Land Tax (SDLT) will be replaced by the new Land & Buildings Transaction Tax (LBTT).

What's changing?

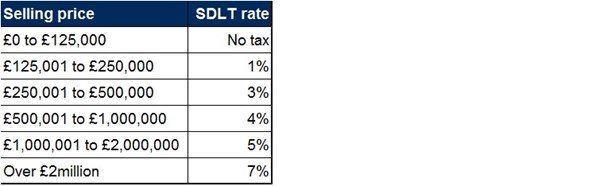

Under the existing Stamp Duty Land Tax, residential property sales were subject to a tax based on the selling price of the property. There were six tax bands as indicated below:

This tax is paid on the entire selling price of the property.

Under the proposed LBTT, tax will still be paid depending on the selling price of the property but the bands themselves are changing and the tax will only be applied to the portion of the selling price over each band. The proposed bands are shown below:

So, for example if a property is bought for £150,000, under the proposed LBTT system will only be applied on the part of the selling price over £135,000. That is, the buyer will pay 2% of £15,000 leading to a tax bill of £300.

If a property sells for £270,000, tax will be paid at 2% on every pound between £135,000 and £250,000, and then at 10% for every pound over the next threshold of £250,000. The total tax paid in this case would thus be:

2% * (250000 – 135000) + 10% * (270000 - 250000) = (0.02*115000) + (0.1*20000)

=£4,300

Why the change?

The Scottish Government has two main aims in implementing these changes. Firstly, under the existing Stamp Duty system, because the tax is applied to the entire selling price and not just the portion of the price over each threshold, there are some pretty big jumps in tax around each threshold.

For example with Stamp Duty, a property bought for £249,000 will incur tax of £2,490. A property bought for £251,000 will incur a tax bill of £7,530 – a jump in tax of more than £5,000.

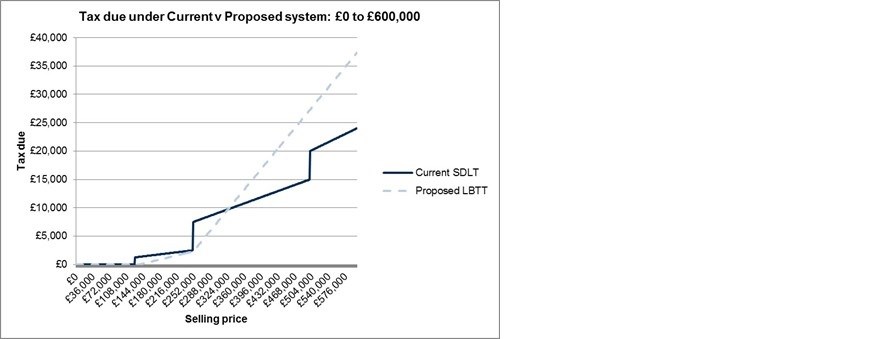

The second objective the Government has is to shift the burden of tax liability such that those towards the lower end of the market would pay less, while those further up the property ladder will pay more.

Who wins and who loses?

In simple terms:

- Everyone buying a residential property for £125,000 or less will be unaffected. They don’t pay anything under SDLT and still won’t under the proposed LBTT.

- People buying a home for between £125,000 and £135,000 will be exempt from paying tax under LBTT and therefore would be better off.

- Everyone else buying for less than £324,300 will pay less tax under the proposed LBTT than is currently the case under SDLT.

- Those buying a home for over £324,300 will pay more tax under the proposed new system.

The chart below illustrates the tax paid under existing SDLT as compared to the proposed LBTT system for properties up to a selling price of £600,000.

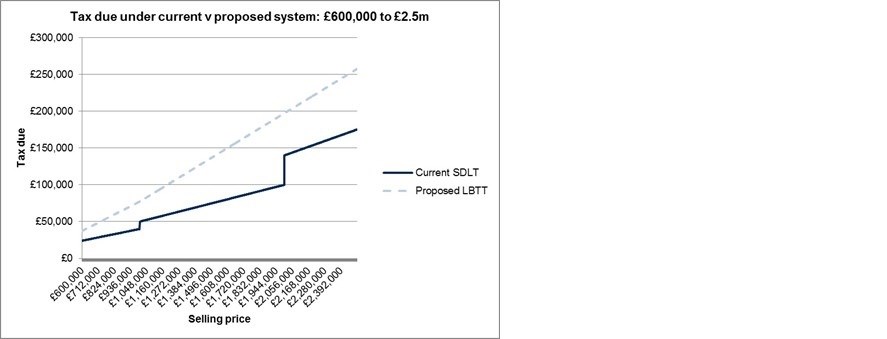

And this chart shows the tax due for properties at £600,000 to £2.5million.

Where can I get more information

The Scottish Government has details of the Land and Buildings Transaction Tax (Scotland) Act 2013 here.

They also have a calculator online that you can access here to see how much tax you'd pay under the proposed LBTT.

Alternatively, do feel free to give us a call or pop into our showroom on Geroge Street in Edinburgh or New Row in Dunfermline and one of our friendly advisers will be more than happy to help.

Note: This article was originally published on 11 October 2014 prior to changes announced to SDLT in the chancellor's Autumn Statement. For the latest information on changes to tax paid on residential property transactions, click here.