Help to Buy: Everything you need to know

Two new Help to buy schemes have been announced, but what are they and what do they mean for house hunters?

Put simply, Help to buy could help you either get on the property ladder, or move up it and purchase a new home with just a 5% deposit. ESPC, No.1 for property in East Central Scotland, is the place to start to use Help to Buy to help you purchase your dream property in Edinburgh, or anywhere.

We’ve summarised the key points to help you understand what they are and how they could potentially help you.

Two schemes

There are two schemes available:

- Mortgage guarantee (resale and new build) on properties up to £600,000

- Equity loan (new build only) on properties up to £400,000 in Scotland only

1. Help to Buy: Mortgage guarantee scheme

The Help to Buy: mortgage guarantee scheme is designed to help house hunters access a low-deposit mortgage, assisting those who may find it difficult to save for the deposit (perhaps as a result of rising rental costs) but are able to afford the mortgage repayments on an on-going basis. It lets buyers purchase a resale property advertised for sale (as well as new builds).

Affordability is key. All potential buyers will be faced with checks to ensure that they can afford their mortgage payments and their income will be verified. If you have a history of difficulties with repaying debts, these new mortgages may not be available to you.

How it works

Here’s a summary of the key points to note with the guarantee scheme:

- You will need to have a deposit of at least 5%

- The UK Government and the bank jointly act as guarantors for up to 15% of the property's value.

- The Government is providing a guarantee should the property be repossessed.

- You are essentially taking out a 95% mortgage.

- This is not a shared-equity scheme.

- You may have to pay a fee to the lender.

- The maximum price for properties eligible to take part in the scheme is £600,000.

- The interest rate payable will vary between lenders but are likely to be around or just over 5%.

- The scheme will not include interest-only or self-certified mortgages.

2. Help to buy (Scotland): Equity loan scheme

This scheme is open to first time buyers, as well as those who have previously owned property, and is available on new build properties being marketed by participating builders only.

The property that you buy must be your only home. If you are already a home owner, you must sell this property before purchasing with the Help to Buy (Scotland) scheme.

Certain criteria with regards to affordability will impact on your eligibility to apply. Your mortgage repayments, monthly fees and costs must not exceed 45% of your net disposable income.

How it works

Here’s a summary of the key points to note with the equity loan scheme

- You will be expected to pay a 5% deposit of the full purchase price.

- The Scottish Government will take an equity stake of up to 20% of the value of the property

- The mortgage and deposit must cover a combined minimum of 80% of the total purchase price.

- The maximum price for properties eligible to take part in the scheme is £400,000.

- The mortgage must be taken on a repayment basis. You cannot opt for an interest-only mortgage under the Help to Buy (Scotland) scheme.

- You pay back the equity loan to the Scottish Government when you sell your home from a share of out of the sale proceeds.

- During the ownership you will have the option to increase your equity share by a minimum of at least 5% in any one year and you may increase your share up to 100% if you choose to do so. Any increase is subject to you paying all valuation and other legal costs and expenses. For example, if you purchased an initial equity stake of 85% and one year later you decide you wish to purchase an additional 5% share, you may do so.

Talk to the experts first

Look out for our free ESPC Showroom, Help to Buy information events which you can attend after work to help you get to grips with this new scheme.

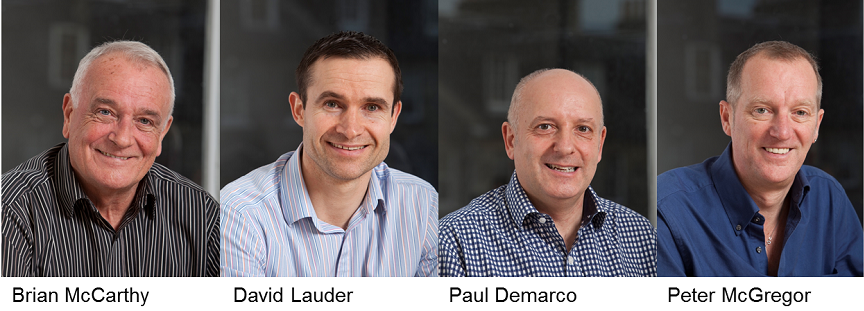

Find out more from the ESPC experts To discuss your options, affordability and find out if you would be eligible to apply for a Help to Buy scheme speak with an ESPC Mortgages’ independent mortgage adviser.

This will ensure that you fully understand the process, can afford the repayments and other associated costs. The equity loan scheme stipulates that all potential buyers must speak to a lender or an independent financial adviser in the first instance.

Your application will only be considered by one of the agents who administer the scheme if you have spoken to a lender or an independent financial adviser. Contact one of the team today on 0131 253 2920 or email fsenquiries@espc.com

The initial consultation with an adviser is free and without any obligation on your part. Thereafter, ESPC Mortgages charges for mortgage advice are usually £350 (£250 for first time buyers). YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.