Five years on: How Edinburgh’s property market transformed post-COVID

From market resilience to shifting buyer priorities, a five-year review of Edinburgh’s real estate landscape by ESPC CEO, Paul Hilton

In March 2020, the Coronavirus pandemic swept through the country at an alarming rate, resulting in never before seen lockdown restrictions being implemented. The country ground to a halt and, like many sectors, this had a large scale impact on the property market. Restrictions meant house moves and related activities could not go ahead unless deemed “reasonably necessary”, resulting in steep drops in property sales and listing volumes during the traditionally busy spring period. We take a look at the long term impact of the lockdown and the property market restrictions.

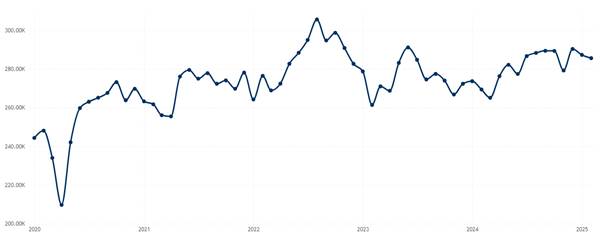

Since 2020, property prices have surged 15%, with the average selling price in Edinburgh, the Lothians, Fife and the Borders now standing at £286,443(Dec 24-Feb 25), up from £249,906 in Dec 2019 to February 2020.

Average selling price in Edinburgh, the Lothians, Fife and the Borders between 1st January 2020 and 28th February 2025. Source: ESPC

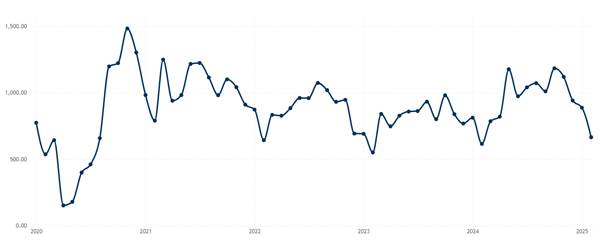

Sales volumes during this time have fluctuated greatly. With a significant drop in listings in spring 2020, the market bounced back with vengeance when the restrictions eased at the end of June. In the final quarter of 2020, the number of homes coming to market in Edinburgh, the Lothians, Fife and the Borders was up by almost 40% annually.

Property sales in Edinburgh, the Lothians, Fife and the Borders between 1st January 2020 and 28th February 2025. Source: ESPC

There was a huge surge in buyer demand once lockdown lifted, with the demand far exceeding pre-covid interest when the market re-opened. In the first three weeks of the market re-opening, web traffic to espc.com was up 75% annually.

There was also a strong trend of home owners realising that their current property didn’t suit the lifestyle that lockdown now demanded. Priority was placed on outdoor space, increased living space to support working from home, with home offices becoming must-have features, and a move to working from home resulting in less demand for city centre living.

The introduction of lockdown and property viewing restrictions brought about changes in the way that buyers research properties. Videos and virtual tours became key. Prior to the pandemic, a property video was a nice to have. It’s now an essential element to the property marketing mix. Savvy solicitor estate agents conducted online views via Zoom, showcasing the properties in a personalised way without mass viewings. We also have subsequently seen a decline in open house viewings. Pre-pandemic almost every property advertised in Edinburgh had an open viewing slot on a Thursday evening and a Sunday afternoon. This trend has rapidly declined, with just 3% of homes on the market today with these previously popular viewing slots.

The market recovered quickly from the shock shutdown, with properties being snapped up swiftly, with a median time of just 20 days to under offer between July and December 2020. This gradually increasing to more normal rates as the market started to realign with more steady demand rates, currently sitting at a still swift, 27 days.

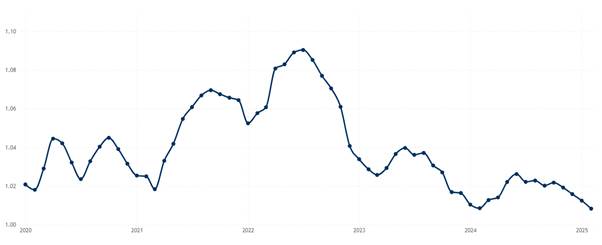

But the lockdown is not the only challenge that the property sector has faced in the last five years. We’ve also weathered the storm of the cost of living crisis, raising interest rates and the fall out from the disastrous Truss mini budget in September 2022 and the Bank of England base rate reaching 5.25% in August 2023. This saw more change within the market. After a period of buyers needing to pay far in excess of the Home Report valuation (a high of 108.7% in the summer of 2022) to secure a property, the impact of the mini-budget was an overall drop in the average percentage of Home Report valuation attained. Properties, on average, are currently selling for much closer to their Home Report valuation (101.3%).

Average percentage of Home Report valuation achieved in Edinburgh, the Lothians, Fife and the Borders between 1st January 2020 and 28th February 2025. Source: ESPC

This also caused a slight dip in the number of new homes brought to market and sold throughout 2023, before stability and subsequent drops in interest rates throughout 2024 caused more confidence to return from buyers and sellers.

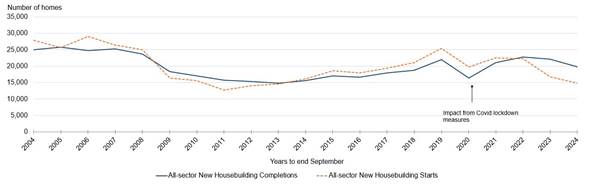

Another point to note is the declaration of a local housing crisis in Edinburgh in November 2023, followed by a nationwide announcement in May 2024, which recognises the vast shortage of housing in Scotland. This is not a COVID issue. The declines in new build home completions over the last 20 years, and lack of investment in quality housing of all tenures has resulted in the current property shortage, resulting in the impact of some of these events perhaps being less dramatic than they had the potential for.

All Sector new housebuilding starts and completions, 2004 to 2024 (year to end September). Source

In the current market, we are seeing increasing chains of property transactions locally, which can result in more complex conveyancing requirements to keep everything moving. The unique expertise of the ESPC membership is vital here to navigate these challenges, and keep the property sector moving.

How has the market transformed post-COVID? The market is more dynamic, and like with many industries has an online first approach. Priority is placed on quality video and photography, with house hunters carefully vetting properties before securing viewings. Demand remains steady. The housing market in Scotland, but particularly Edinburgh is incredibly resilient. The market has weathered the storms of the last five years well, coming out stronger, with good choice for both buyers and sellers, but in a balanced market where all parties have a great opportunity to get the best deal for them.